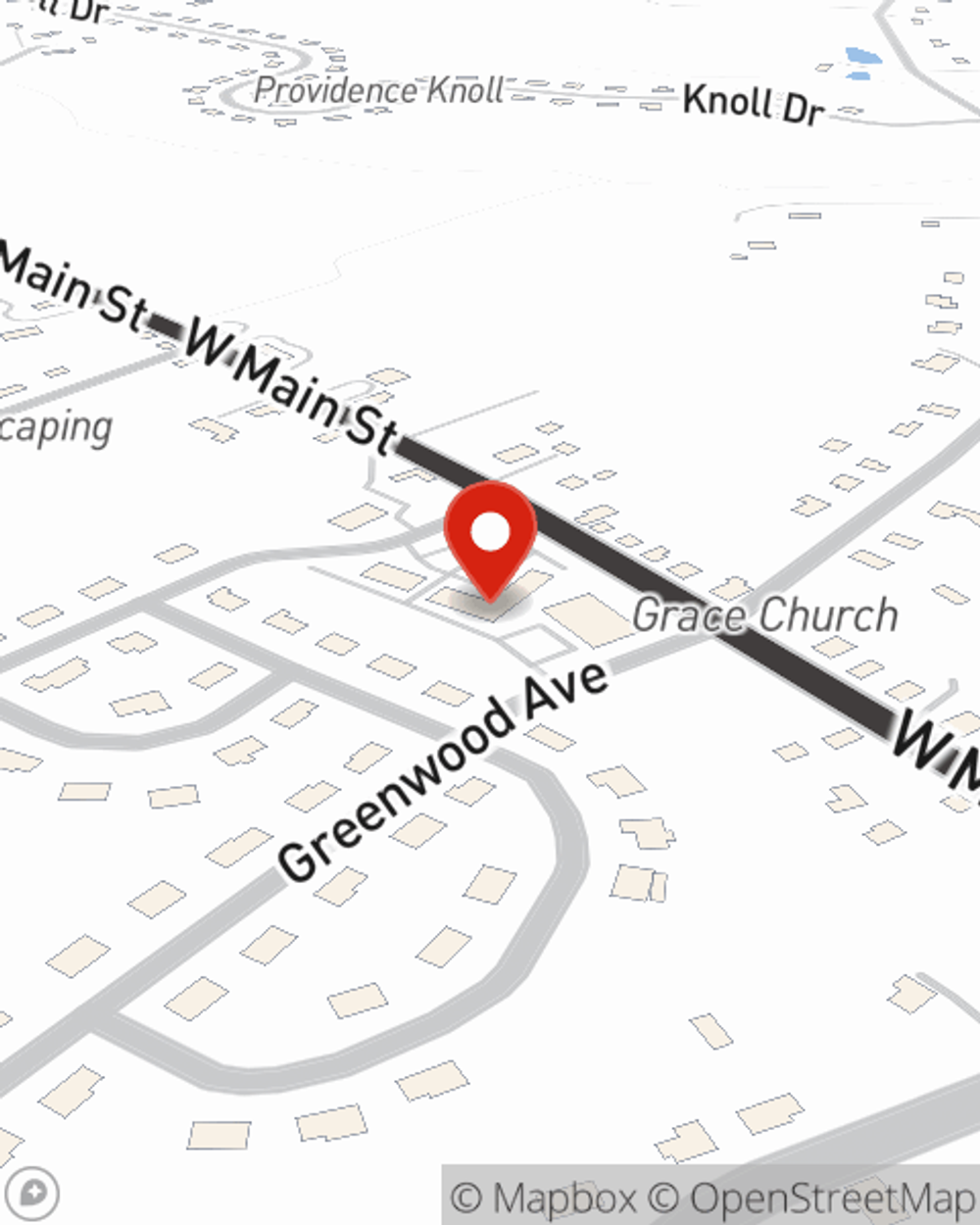

Condo Insurance in and around Collegeville

Looking for excellent condo unitowners insurance in Collegeville?

State Farm can help you with condo insurance

- Limerick

- Royersford

- Pottstown

- Schwenksville

- Reading

- Philadelphia

- Gilbertsville

- King of Prussia

- Norristown

- Douglassville

- Lansdale

- Boyertown

There’s No Place Like Home

With the variety of condo insurance options to choose from, you may be feeling overwhelmed. That's why we made choosing State Farm easy. As one of the leading providers of condo unitowners insurance, you can enjoy impressive service and coverage that is competitively priced. And this is not only for your condo but also for your personal belongings inside, including things like home gadgets, linens and tools.

Looking for excellent condo unitowners insurance in Collegeville?

State Farm can help you with condo insurance

Put Those Worries To Rest

Everyone knows having condominium unitowners insurance is essential in case of a hailstorm, fire or ice storm. Sufficient condo unitowners insurance can help if your condo is destroyed, so you aren’t left with the bill for a home that isn’t habitable. An additional feature of condo unitowners insurance is its ability to protect you in certain legal situations. If someone trips in your home, you could be held responsible for their lost wages or physical therapy. With adequate condo coverage, you have liability protection in the event of a covered claim.

As a commited provider of condo unitowners insurance in Collegeville, PA, State Farm strives to keep your belongings protected. Call State Farm agent Jason Walborn today for help with all your condominium unitowners insurance needs.

Have More Questions About Condo Unitowners Insurance?

Call Jason at (610) 454-0900 or visit our FAQ page.

Simple Insights®

House hunting

House hunting

House hunting can be a time-consuming process, but with some research and foresight, you may be able to avoid wasted time and expensive risks.

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.

Jason Walborn

State Farm® Insurance AgentSimple Insights®

House hunting

House hunting

House hunting can be a time-consuming process, but with some research and foresight, you may be able to avoid wasted time and expensive risks.

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.